What is a Tax Examiner, Collector, or Revenue Agent?

Tax Examiner, Collector, or Revenue Agent Job Description Determine tax liability or collect taxes from individuals or business firms according to prescribed laws and regulations.

Daily Life Of a Tax Examiner, Collector, or Revenue Agent

- Investigate claims of inability to pay taxes by researching court information for the status of liens, mortgages, or financial statements, or by locating assets through third parties.

- Request that the state or federal revenue service prepare a return on a taxpayer’s behalf in cases where taxes have not been filed.

- Recommend criminal prosecutions or civil penalties.

- Enter tax return information into computers for processing.

- Contact taxpayers by mail or telephone to address discrepancies and to request supporting documentation.

- Process individual and corporate income tax returns, and sales and excise tax returns.

Featured schools near , edit

What a Tax Examiner, Collector, or Revenue Agent Should Know

Tax Examiners, Collectors, and Revenue Agents state the following job skills are important in their day-to-day work.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Active Learning: Understanding the implications of new information for both current and future problem-solving and decision-making.

Types of Tax Examiner, Collector, or Revenue Agent

- Account Clerk

- Inspector

- Tax Auditor

- Tax Associate

- Field Tax Auditor

Are There Job Opportunities for Tax Examiners, Collectors, and Revenue Agents?

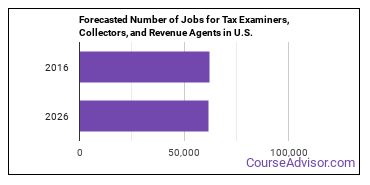

In 2016, there was an estimated number of 62,100 jobs in the United States for Tax Examiner, Collector, or Revenue Agent. There is little to no growth in job opportunities for Tax Examiner, Collector, or Revenue Agent. There will be an estimated 4,200 positions for Tax Examiner, Collector, or Revenue Agent per year.

The states with the most job growth for Tax Examiner, Collector, or Revenue Agent are Nevada, Arkansas, and Oregon. Watch out if you plan on working in Michigan, Missouri, or New Jersey. These states have the worst job growth for this type of profession.

Average Tax Examiners, Collectors, and Revenue Agents Salary

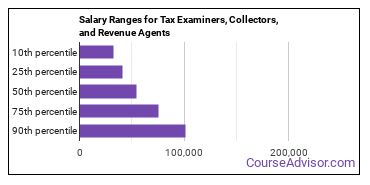

Tax Examiners, Collectors, and Revenue Agents make between $32,500 and $101,120 a year.

Tax Examiners, Collectors, and Revenue Agents who work in Alaska, Connecticut, or Kansas, make the highest salaries.

Below is a list of the median annual salaries for Tax Examiners, Collectors, and Revenue Agents in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $56,860 |

| Alaska | $89,450 |

| Arizona | $75,590 |

| Arkansas | $55,670 |

| California | $66,600 |

| Colorado | $64,980 |

| Connecticut | $84,990 |

| Delaware | $62,230 |

| Florida | $47,300 |

| Georgia | $50,490 |

| Hawaii | $72,410 |

| Idaho | $52,430 |

| Illinois | $77,970 |

| Indiana | $52,940 |

| Iowa | $67,060 |

| Kansas | $78,330 |

| Kentucky | $48,540 |

| Louisiana | $51,510 |

| Maine | $54,690 |

| Maryland | $60,990 |

| Massachusetts | $70,780 |

| Michigan | $73,940 |

| Minnesota | $64,700 |

| Mississippi | $45,590 |

| Missouri | $47,590 |

| Montana | $59,270 |

| Nebraska | $59,500 |

| New Hampshire | $55,770 |

| New Jersey | $74,380 |

| New Mexico | $46,850 |

| New York | $70,560 |

| North Carolina | $59,970 |

| North Dakota | $67,120 |

| Ohio | $66,440 |

| Oklahoma | $49,250 |

| Oregon | $58,630 |

| Pennsylvania | $48,580 |

| Rhode Island | $72,190 |

| South Carolina | $54,420 |

| South Dakota | $52,300 |

| Tennessee | $55,950 |

| Texas | $58,040 |

| Utah | $49,680 |

| Vermont | $57,390 |

| Virginia | $53,870 |

| Washington | $65,170 |

| West Virginia | $49,230 |

| Wisconsin | $62,950 |

| Wyoming | $57,100 |

Tools & Technologies Used by Tax Examiners, Collectors, and Revenue Agents

Below is a list of the types of tools and technologies that Tax Examiners, Collectors, and Revenue Agents may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Microsoft Access

- Email software

- SAP

- Intuit QuickBooks

- Tax software

- Fund accounting software

- ADP Workforce Now

- Document management system software

- Online databases

- Optical character recognition OCR software

- Image processing systems

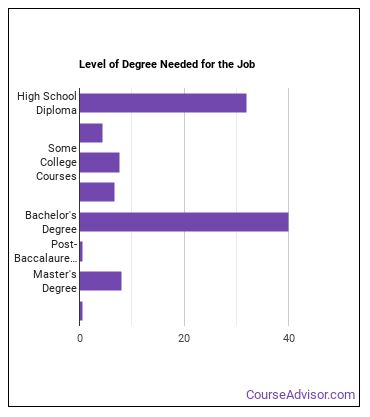

How to Become a Tax Examiner, Collector, or Revenue Agent

Learn what Tax Examiner, Collector, or Revenue Agent education requirements there are.

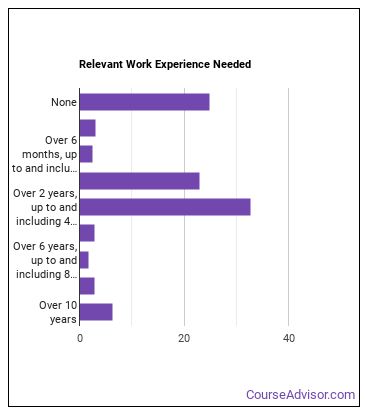

How many years of work experience do I need?

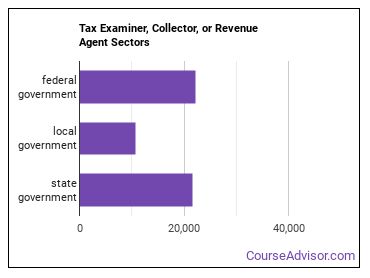

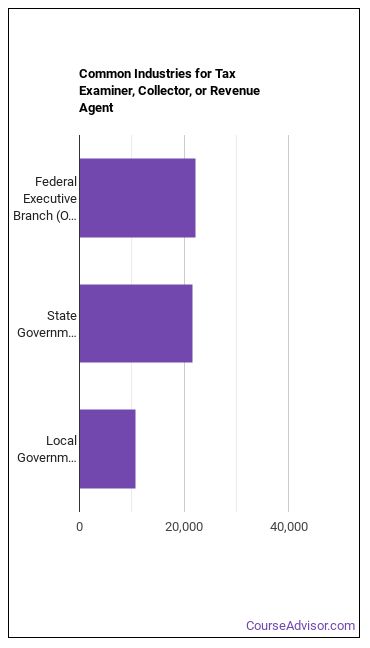

Where do Tax Examiners, Collectors, and Revenue Agents Work?

The table below shows the approximate number of Tax Examiners, Collectors, and Revenue Agents employed by various industries.

Other Jobs You May be Interested In

Those interested in being a Tax Examiner, Collector, or Revenue Agent may also be interested in:

- Regulatory Affairs Specialists

- Administrative Services Managers

- Executive Secretaries and Executive Administrative Assistants

- First-Line Supervisors of Retail Sales Workers

- Accountants

Career changers with experience as a Tax Examiner, Collector, or Revenue Agent sometimes find work in one of the following fields:

References:

Image Credit: Pixabay via CC0 License

More about our data sources and methodologies.

Featured Schools

Request Info

Request Info

|

Southern New Hampshire University You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs. Learn More > |