What Do Property and Casualty Insurance Claims Examiner Do?

Example of Insurance Claims Examiner Job Review settled insurance claims to determine that payments and settlements have been made in accordance with company practices and procedures. Report overpayments, underpayments, and other irregularities. Confer with legal counsel on claims requiring litigation.

Daily Life Of an Insurance Claims Examiner

- Confer with legal counsel on claims requiring litigation.

- Report overpayments, underpayments, and other irregularities.

- Enter claim payments, reserves and new claims on computer system, inputting concise yet sufficient file documentation.

- Supervise claims adjusters to ensure that adjusters have followed proper methods.

- Examine claims investigated by insurance adjusters, further investigating questionable claims to determine whether to authorize payments.

- Investigate, evaluate, and settle claims, applying technical knowledge and human relations skills to effect fair and prompt disposal of cases and to contribute to a reduced loss ratio.

Featured schools near , edit

Skills Needed to be an Insurance Claims Examiner

These are the skills Property and Casualty Insurance Claims Examiners say are the most useful in their careers:

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Negotiation: Bringing others together and trying to reconcile differences.

Related Job Titles

- Liability Claims Representative

- Claims Account Specialist

- Workers Compensation Claims Examiner

- Claims Supervisor

- Claims Account Manager

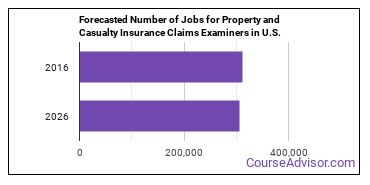

Is There Job Demand for Property and Casualty Insurance Claims Examiners?

There were about 311,100 jobs for Property and Casualty Insurance Claims Examiner in 2016 (in the United States). There is little to no growth in job opportunities for Property and Casualty Insurance Claims Examiner. The BLS estimates 24,500 yearly job openings in this field.

The states with the most job growth for Insurance Claims Examiner are Utah, Arizona, and Colorado. Watch out if you plan on working in Maine, District of Columbia, or Mississippi. These states have the worst job growth for this type of profession.

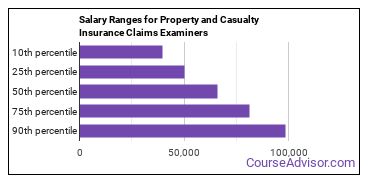

Insurance Claims Examiner Salary

The average yearly salary of an Insurance Claims Examiner ranges between $39,620 and $98,660.

Property and Casualty Insurance Claims Examiners who work in Connecticut, Massachusetts, or New Jersey, make the highest salaries.

How much do Property and Casualty Insurance Claims Examiners make in different U.S. states?

| State | Annual Mean Salary |

|---|---|

| Alabama | $65,060 |

| Alaska | $73,370 |

| Arizona | $67,340 |

| Arkansas | $61,930 |

| California | $71,720 |

| Colorado | $72,460 |

| Connecticut | $78,590 |

| Delaware | $63,440 |

| District of Columbia | $74,210 |

| Florida | $62,840 |

| Georgia | $65,430 |

| Hawaii | $62,860 |

| Idaho | $63,020 |

| Illinois | $65,980 |

| Indiana | $63,480 |

| Iowa | $62,750 |

| Kansas | $67,570 |

| Kentucky | $55,820 |

| Louisiana | $66,440 |

| Maine | $60,980 |

| Maryland | $72,050 |

| Massachusetts | $76,150 |

| Michigan | $67,860 |

| Minnesota | $65,760 |

| Mississippi | $62,700 |

| Missouri | $66,340 |

| Montana | $55,970 |

| Nebraska | $61,050 |

| Nevada | $65,510 |

| New Hampshire | $71,190 |

| New Jersey | $74,260 |

| New Mexico | $63,890 |

| New York | $71,950 |

| North Carolina | $62,580 |

| North Dakota | $58,580 |

| Ohio | $65,890 |

| Oklahoma | $61,670 |

| Oregon | $67,750 |

| Pennsylvania | $67,730 |

| Rhode Island | $71,950 |

| South Carolina | $62,950 |

| South Dakota | $61,490 |

| Tennessee | $60,550 |

| Texas | $69,560 |

| Utah | $59,330 |

| Vermont | $66,240 |

| Virginia | $63,640 |

| Washington | $72,340 |

| West Virginia | $57,030 |

| Wisconsin | $63,420 |

| Wyoming | $65,300 |

What Tools do Property and Casualty Insurance Claims Examiners Use?

Below is a list of the types of tools and technologies that Property and Casualty Insurance Claims Examiners may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Publisher

- Medical procedure coding software

- Healthcare common procedure coding system HCPCS

- Medical condition coding software

- Document management system software

- Hyland OnBase Enterprise Content Management

- Axonwave Fraud and Abuse Management System

- StrataCare StrataWare eReview

- LexisNexis RiskWise

- CCC Pathways Appraisal Quality Solution

- ISO NetMap for Claims

- ISO ClaimSearch

- IBM Fraud and Abuse Management System

- Hummingbird Legal Bill Review

- Agency Management Systems AMS 360

- AutoClaims Direct DirectLink

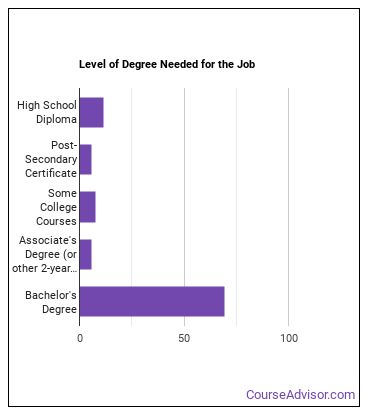

Becoming an Insurance Claims Examiner

Individuals working as a Property and Casualty Insurance Claims Examiner have obtained the following education levels:

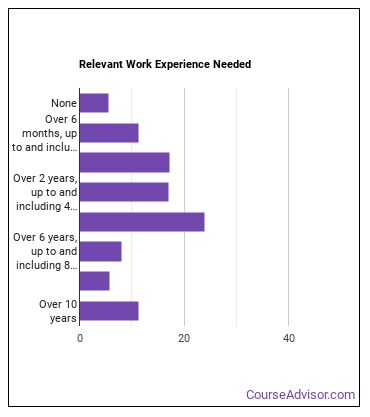

What work experience do I need to become an Insurance Claims Examiner?

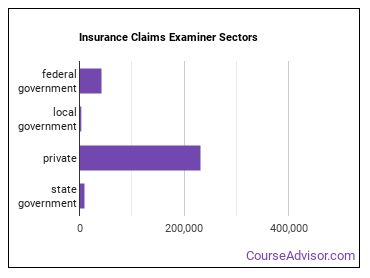

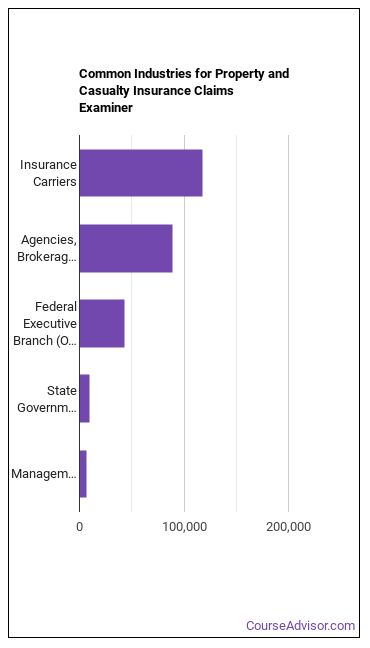

Who Employs Property and Casualty Insurance Claims Examiners?

The table below shows some of the most common industries where those employed in this career field work.

You May Also Be Interested In…

Those thinking about becoming a Property and Casualty Insurance Claims Examiner might also be interested in the following careers:

- Social Science Research Assistants

- Loan Counselors

- Cost Estimators

- Title Examiners, Abstractors, and Searchers

- Financial Analysts

Those who work as a Property and Casualty Insurance Claims Examiner sometimes switch careers to one of these choices:

References:

Image Credit: Nick Youngson via Creative Commons 3 - CC BY-SA 3.0

More about our data sources and methodologies.

Featured Schools

Request Info

Request Info

|

Southern New Hampshire University You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs. Learn More > |