Life As an Insurance Underwriter

Job Description & Duties Review individual applications for insurance to evaluate degree of risk involved and determine acceptance of applications.

Insurance Underwriter Responsibilities

- Authorize reinsurance of policy when risk is high.

- Decrease value of policy when risk is substandard and specify applicable endorsements or apply rating to ensure safe, profitable distribution of risks, using reference materials.

- Review company records to determine amount of insurance in force on single risk or group of closely related risks.

- Examine documents to determine degree of risk from factors such as applicant health, financial standing and value, and condition of property.

- Evaluate possibility of losses due to catastrophe or excessive insurance.

- Decline excessive risks.

Featured schools near , edit

Skills Needed to be an Insurance Underwriter

Below is a list of the skills most Insurance Underwriters say are important on the job.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Speaking: Talking to others to convey information effectively.

Judgment and Decision Making: Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Related Job Titles for this Occupation:

- Underwriting Account Representative

- Underwriting Director

- Commercial Lines Underwriter

- Underwriting Consultant

- Underwriting Manager

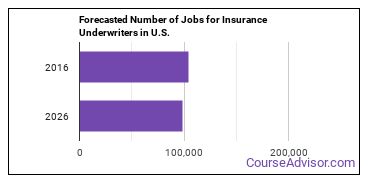

Is There Going to be Demand for Insurance Underwriters?

In 2016, there was an estimated number of 104,100 jobs in the United States for Insurance Underwriter. There is little to no growth in job opportunities for Insurance Underwriter. There will be an estimated 7,500 positions for Insurance Underwriter per year.

The states with the most job growth for Insurance Underwriter are Utah, Arizona, and Maryland. Watch out if you plan on working in Vermont, Maine, or Wyoming. These states have the worst job growth for this type of profession.

How Much Does an Insurance Underwriter Make?

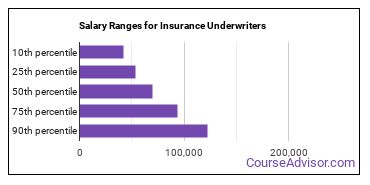

The average yearly salary of an Insurance Underwriter ranges between $42,260 and $122,840.

Insurance Underwriters who work in New Hampshire, District of Columbia, or New Jersey, make the highest salaries.

Below is a list of the median annual salaries for Insurance Underwriters in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $60,750 |

| Alaska | $67,430 |

| Arizona | $73,290 |

| Arkansas | $55,290 |

| California | $88,140 |

| Colorado | $77,170 |

| Connecticut | $85,010 |

| Delaware | $67,330 |

| District of Columbia | $87,010 |

| Florida | $70,900 |

| Georgia | $81,290 |

| Hawaii | $67,040 |

| Idaho | $68,710 |

| Illinois | $75,690 |

| Indiana | $77,190 |

| Iowa | $71,680 |

| Kansas | $74,630 |

| Kentucky | $69,940 |

| Louisiana | $69,440 |

| Maine | $68,390 |

| Maryland | $77,650 |

| Massachusetts | $82,540 |

| Michigan | $70,270 |

| Minnesota | $68,410 |

| Mississippi | $65,530 |

| Missouri | $68,250 |

| Montana | $76,830 |

| Nebraska | $68,120 |

| Nevada | $67,260 |

| New Hampshire | $81,280 |

| New Jersey | $88,510 |

| New Mexico | $61,050 |

| New York | $92,810 |

| North Carolina | $78,220 |

| North Dakota | $68,310 |

| Ohio | $74,370 |

| Oklahoma | $59,820 |

| Oregon | $72,570 |

| Pennsylvania | $77,300 |

| Rhode Island | $71,260 |

| South Carolina | $55,320 |

| South Dakota | $78,370 |

| Tennessee | $68,630 |

| Texas | $68,390 |

| Utah | $60,040 |

| Vermont | $65,610 |

| Virginia | $68,950 |

| Washington | $81,210 |

| West Virginia | $58,830 |

| Wisconsin | $68,670 |

What Tools & Technology do Insurance Underwriters Use?

Although they’re not necessarily needed for all jobs, the following technologies are used by many Insurance Underwriters:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Web browser software

- Word processing software

- Spreadsheet software

- Database software

- LexisNexis

- Delphi Technology

- C++

- Fannie Mae Desktop Underwriter

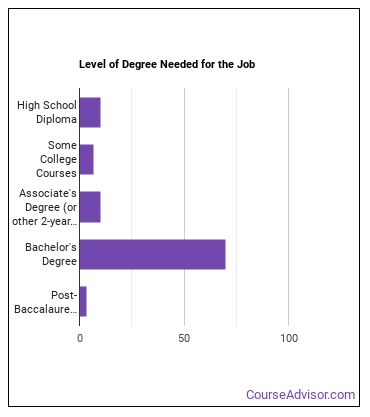

How to Become an Insurance Underwriter

Individuals working as an Insurance Underwriter have obtained the following education levels:

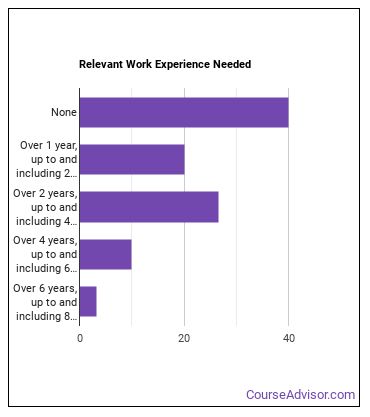

How Long Does it Take to Become an Insurance Underwriter?

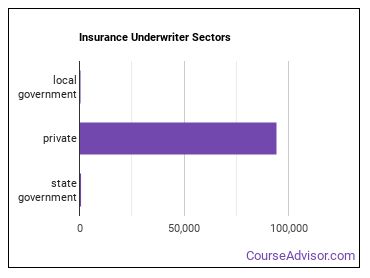

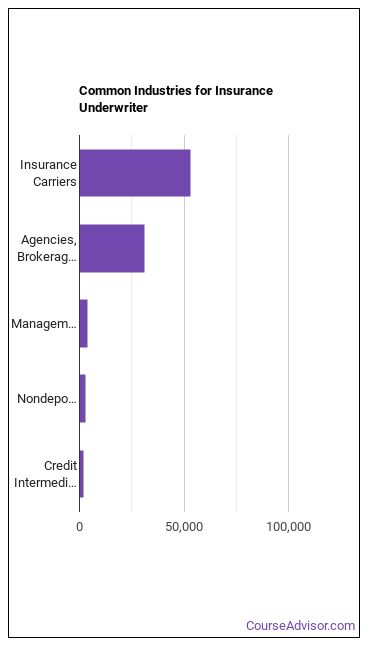

Insurance Underwriters Sector

The table below shows some of the most common industries where those employed in this career field work.

References:

Image Credit: Nick Youngson via Creative Commons 3 - CC BY-SA 3.0

More about our data sources and methodologies.

Featured Schools

Request Info

Request Info

|

Southern New Hampshire University You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs. Learn More > |