Life As a Teller

Teller Job Description Receive and pay out money. Keep records of money and negotiable instruments involved in a financial institution’s various transactions.

Life As a Teller: What Do They Do?

- Process transactions, such as term deposits, retirement savings plan contributions, automated teller transactions, night deposits, and mail deposits.

- Explain, promote, or sell products or services, such as travelers’ checks, savings bonds, money orders, and cashier’s checks, using computerized information about customers to tailor recommendations.

- Compose, type, and mail customer statements and other correspondence related to issues such as discrepancies and outstanding unpaid items.

- Receive checks and cash for deposit, verify amounts, and check accuracy of deposit slips.

- Prepare work schedules for staff.

- Examine checks for endorsements and to verify other information, such as dates, bank names, identification of the persons receiving payments, and the legality of the documents.

Featured schools near , edit

What a Teller Should Know

Tellers state the following job skills are important in their day-to-day work.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Monitoring: Monitoring/Assessing performance of yourself, other individuals, or organizations to make improvements or take corrective action.

Service Orientation: Actively looking for ways to help people.

Social Perceptiveness: Being aware of others’ reactions and understanding why they react as they do.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Other Teller Job Titles

- Securities Teller

- Customer Relationship Specialist

- Utility Teller

- Drive-in Teller

- Operations Specialist

Are There Job Opportunities for Tellers?

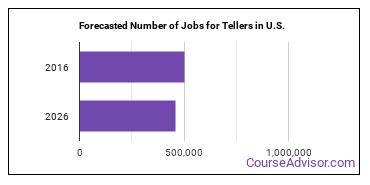

In 2016, there was an estimated number of 502,700 jobs in the United States for Teller. There is little to no growth in job opportunities for Teller. The BLS estimates 51,500 yearly job openings in this field.

The states with the most job growth for Teller are Utah, Arizona, and Texas. Watch out if you plan on working in Wyoming, Illinois, or Pennsylvania. These states have the worst job growth for this type of profession.

How Much Does a Teller Make?

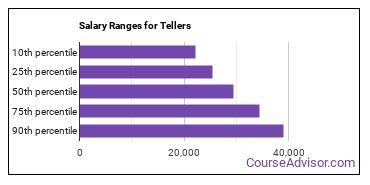

The salary for Tellers ranges between about $22,250 and $39,110 a year.

Tellers who work in District of Columbia, Washington, or Maryland, make the highest salaries.

How much do Tellers make in different U.S. states?

| State | Annual Mean Salary |

|---|---|

| Alabama | $27,830 |

| Alaska | $30,710 |

| Arizona | $30,370 |

| Arkansas | $25,640 |

| California | $32,120 |

| Colorado | $30,810 |

| Connecticut | $33,360 |

| Delaware | $30,670 |

| District of Columbia | $35,790 |

| Florida | $32,140 |

| Georgia | $30,670 |

| Hawaii | $32,050 |

| Idaho | $28,660 |

| Illinois | $29,860 |

| Indiana | $27,900 |

| Iowa | $28,480 |

| Kansas | $28,150 |

| Kentucky | $27,770 |

| Louisiana | $27,850 |

| Maine | $30,080 |

| Maryland | $32,330 |

| Massachusetts | $32,860 |

| Michigan | $30,150 |

| Minnesota | $30,270 |

| Mississippi | $27,380 |

| Missouri | $27,800 |

| Montana | $28,760 |

| Nebraska | $29,620 |

| Nevada | $30,050 |

| New Hampshire | $29,780 |

| New Jersey | $32,950 |

| New Mexico | $27,050 |

| New York | $31,680 |

| North Carolina | $32,100 |

| North Dakota | $31,800 |

| Ohio | $28,990 |

| Oklahoma | $26,240 |

| Oregon | $30,390 |

| Pennsylvania | $29,360 |

| Rhode Island | $31,520 |

| South Carolina | $30,490 |

| South Dakota | $27,230 |

| Tennessee | $28,100 |

| Texas | $28,710 |

| Utah | $27,800 |

| Vermont | $30,850 |

| Virginia | $31,220 |

| Washington | $34,240 |

| West Virginia | $26,220 |

| Wisconsin | $28,870 |

| Wyoming | $28,810 |

What Tools & Technology do Tellers Use?

Below is a list of the types of tools and technologies that Tellers may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Email software

- Word processing software

- Microsoft Windows

- Microsoft Dynamics

- IBM Notes

- Sage 50 Accounting

- Internet browser software

- Accounting software

- Hyland Software OnBase

How do I Become a Teller?

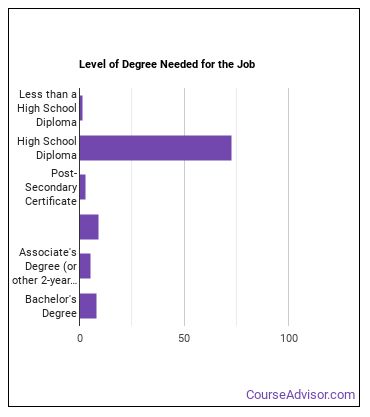

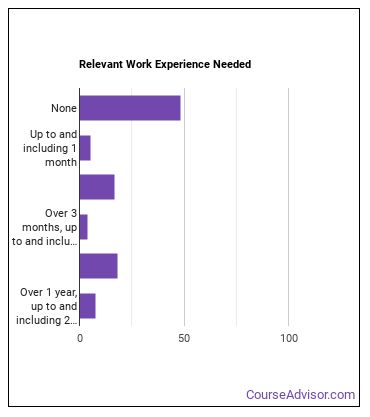

What education or degrees do I need to become a Teller?

How Long Does it Take to Become a Teller?

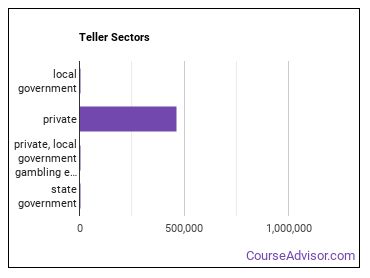

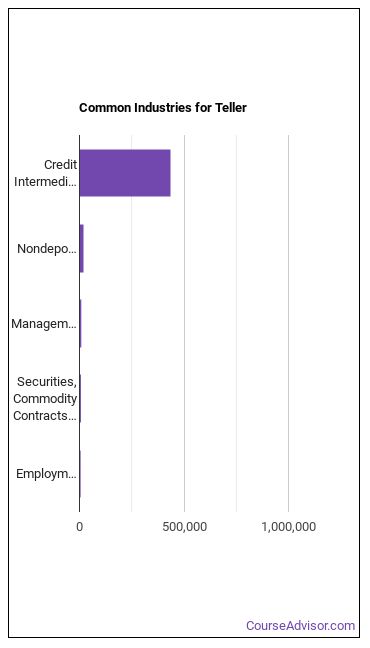

Tellers Sector

The table below shows some of the most common industries where those employed in this career field work.

Similar Careers

Those thinking about becoming a Teller might also be interested in the following careers:

- Reservation and Transportation Ticket Agents and Travel Clerks

- Data Entry Keyers

- Brokerage Clerks

- Customer Service Representatives

Are you already one of the many Teller in the United States? If you’re thinking about changing careers, these fields are worth exploring:

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.

Featured Schools

Request Info

Request Info

|

Southern New Hampshire University You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs. Learn More > |