Taxation at Hofstra University

If you are interested in studying taxation, you may want to check out the program at Hofstra University. The following information will help you decide if it is a good fit for you.Hofstra is located in Hempstead, New York and has a total student population of 10,444.

Want to know more about the career opportunities in this field? Check out the Careers in Taxation section at the bottom of this page.

Hofstra Taxation Degrees Available

- Master’s Degree in Taxation

Hofstra Taxation Rankings

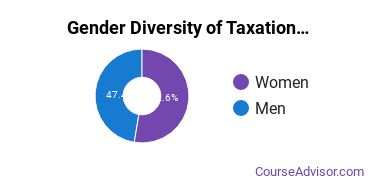

Taxation Student Demographics at Hofstra

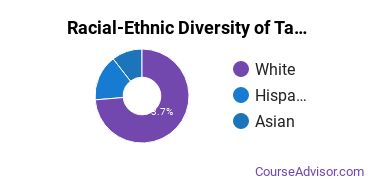

Take a look at the following statistics related to the make-up of the taxation majors at Hofstra University.

Hofstra Taxation Master’s Program

Of the students who received a taxation master's degree from Hofstra, 73% were white. This is above average for this degree on the natiowide level.

The following table and chart show the race/ethnicity for students who recently graduated from Hofstra University with a master's in taxation.

| Race/Ethnicity | Number of Students |

|---|---|

| Asian | 0 |

| Black or African American | 1 |

| Hispanic or Latino | 0 |

| White | 8 |

| International Students | 0 |

| Other Races/Ethnicities | 2 |

Concentrations Within Taxation

If you plan to be a taxation major, you may want to focus your studies on one of the following concentrations. The table shows all degrees awarded in this field awarded for all degree levels at Hofstra University. A concentration may not be available for your level.

| Concentration | Annual Degrees Awarded |

|---|---|

| Taxation | 19 |

Related Majors

- Management Information Systems

- Human Resource Management

- Entrepreneurial Studies

- Business/Managerial Economics

- International Business

Careers That Taxation Grads May Go Into

A degree in taxation can lead to the following careers. Since job numbers and average salaries can vary by geographic location, we have only included the numbers for NY, the home state for Hofstra University.

| Occupation | Jobs in NY | Average Salary in NY |

|---|---|---|

| Accountants and Auditors | 110,780 | $96,300 |

| Financial Examiners | 9,030 | $115,980 |

| Tax Examiners, Collectors, and Revenue Agents | 4,830 | $70,560 |

| Tax Preparers | 4,070 | $63,440 |

References

*The racial-ethnic minorities count is calculated by taking the total number of students and subtracting white students, international students, and students whose race/ethnicity was unknown. This number is then divided by the total number of students at the school to obtain the racial-ethnic minorities percentage.

- College Factual

- National Center for Education Statistics

- O*NET Online

- Image Credit: By Dan14641 under License

More about our data sources and methodologies.