Taxation at Bentley University

What traits are you looking for in a taxation school? To help you decide if Bentley University is right for you, we've gathered the following information about the school's taxation program.Bentley is located in Waltham, Massachusetts and approximately 5,177 students attend the school each year.

Want to know more about the career opportunities in this field? Check out the Careers in Taxation section at the bottom of this page.

Bentley Taxation Degrees Available

- Master’s Degree in Taxation

Bentley Taxation Rankings

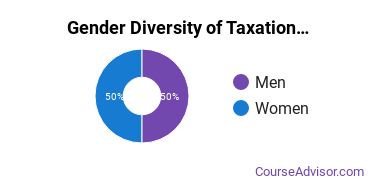

Taxation Student Demographics at Bentley

Take a look at the following statistics related to the make-up of the taxation majors at Bentley University.

Bentley Taxation Master’s Program

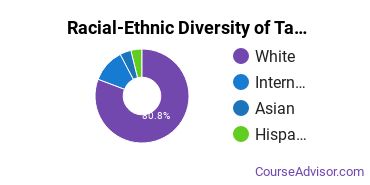

Of the students who received a taxation master's degree from Bentley, 62% were white. This is above average for this degree on the natiowide level.

The following table and chart show the race/ethnicity for students who recently graduated from Bentley University with a master's in taxation.

| Race/Ethnicity | Number of Students |

|---|---|

| Asian | 7 |

| Black or African American | 0 |

| Hispanic or Latino | 2 |

| White | 18 |

| International Students | 0 |

| Other Races/Ethnicities | 2 |

Concentrations Within Taxation

Taxation majors may want to concentrate their studies in one of these areas. The completion numbers here include all graduates who receive any type of degree in this field from Bentley University. Some of these focus areas may not be available for your degree level.

| Concentration | Annual Degrees Awarded |

|---|---|

| Taxation | 27 |

Related Majors

- General Sales & Marketing

- Business/Corporate Communications

- Business/Managerial Economics

- Marketing

- Other Business, Management & Marketing

Careers That Taxation Grads May Go Into

A degree in taxation can lead to the following careers. Since job numbers and average salaries can vary by geographic location, we have only included the numbers for MA, the home state for Bentley University.

| Occupation | Jobs in MA | Average Salary in MA |

|---|---|---|

| Accountants and Auditors | 35,360 | $81,460 |

| Tax Preparers | 1,600 | $65,670 |

| Tax Examiners, Collectors, and Revenue Agents | 1,480 | $70,780 |

| Financial Examiners | 1,130 | $107,840 |

References

*The racial-ethnic minorities count is calculated by taking the total number of students and subtracting white students, international students, and students whose race/ethnicity was unknown. This number is then divided by the total number of students at the school to obtain the racial-ethnic minorities percentage.

- College Factual

- National Center for Education Statistics

- O*NET Online

- Image Credit: By Rob1646 under License

More about our data sources and methodologies.