Tax Examiners, Collectors, and Revenue Agents in Michigan

Get the information you need to know about working as a Tax Examiner, Collector, or Revenue Agent.

While jobs for Tax Examiners, Collectors, and Revenue Agents in Michigan are decreasing, those who do work in these jobs get paid higher than average.

-

Employment for Tax Examiners, Collectors, and Revenue Agents in Michigan is expected to decrease.

-

Tax Examiners, Collectors, and Revenue Agents in Michigan earn higher salaries than the typical U.S. wage earner.

Featured schools near , edit

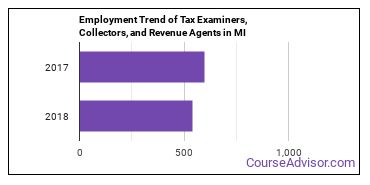

How Many Tax Examiners, Collectors, and Revenue Agents Work in Michigan?

There were approximately 540 workers employed as Tax Examiners, Collectors, and Revenue Agents in this state in 2018.

There were 600 Tax Examiners, Collectors, and Revenue Agents employed in this state in 2017.

That’s a decline of 60 jobs between 2017 and 2018.

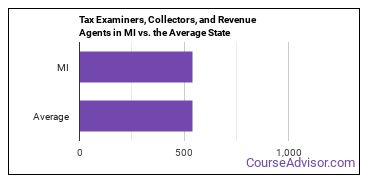

The amount of Tax Examiners, Collectors, and Revenue Agents working in the state is similar to the average state.

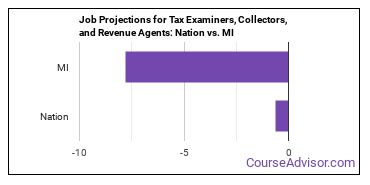

Job Projections for Michigan

Jobs for Tax Examiners, Collectors, and Revenue Agents in this state are declining at a rate of 7.8% which is a faster decline than the nationwide estimated projection of -0.6%.

Michigan Annual Job Openings

The BLS estimates 60 annual job openings, and a total of 950 jobs for Michigan Tax Examiners, Collectors, and Revenue Agents in 2026.

Nationwide, the prediction is 4,200 annual jobs and 61,700 total jobs in 2026.

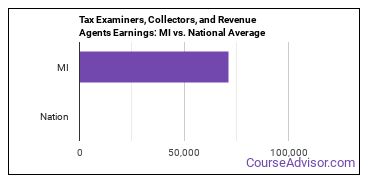

What do Tax Examiners, Collectors, and Revenue Agents Make in Michigan?

In 2018 wages for Tax Examiners, Collectors, and Revenue Agents ranged from $37,910 to $114,580 with $71,460 being the median annual salary.

Broken down to an hourly rate, workers in this field made anywhere from $18.23 to $55.09. The median hourly rate was $34.36.

In 2017 the median pay for this field was $32.68 an hour.

The hourly rate grew by $1.68.

The median salary in Michigan is higher than the nationwide median salary.

Top Michigan Metros for Tax Examiners, Collectors, and Revenue Agents

The table below shows some of the metros in this state with the most Tax Examiners, Collectors, and Revenue Agents.

| Metro | Number Employed | Annual Median Salary |

|---|---|---|

| Detroit-Warren-Dearborn, MI | 330 | $74,350 |

| Grand Rapids-Wyoming, MI | 50 | $88,060 |

Top States for Tax Examiners, Collectors, and Revenue Agents Employment

The table below shows the states where most Tax Examiners, Collectors, and Revenue Agents work.

| State | Number Employed | Annual Median Salary |

|---|---|---|

| California | 8,660 | $60,850 |

| New York | 4,830 | $64,610 |

| Texas | 3,830 | $48,830 |

| Florida | 3,670 | $34,000 |

| Pennsylvania | 3,360 | $48,360 |

| Georgia | 2,020 | $46,550 |

| Utah | 1,840 | $48,390 |

| Missouri | 1,830 | $43,690 |

| Kentucky | 1,570 | $47,010 |

| New Jersey | 1,530 | $72,410 |

| North Carolina | 1,510 | $55,740 |

| Massachusetts | 1,480 | $64,780 |

| Illinois | 1,350 | $76,810 |

| Virginia | 1,340 | $47,440 |

| Ohio | 1,340 | $62,420 |

| Minnesota | 1,080 | $61,200 |

| Alabama | 1,060 | $53,590 |

| Tennessee | 1,030 | $51,000 |

| Washington | 1,000 | $62,070 |

| Connecticut | 920 | $84,420 |

Below are the states where Tax Examiners, Collectors, and Revenue Agents get paid the most:

| State | Annual Median Salary |

|---|---|

| Alaska | $87,060 |

| Connecticut | $84,420 |

| Kansas | $80,710 |

| Illinois | $76,810 |

| Arizona | $73,720 |

| New Jersey | $72,410 |

| Michigan | $71,460 |

| Rhode Island | $71,300 |

| Hawaii | $68,010 |

| Massachusetts | $64,780 |

Related Careers in MI

Discover similar careers:

| Occupation | MI Employment Total |

|---|

References

- Bureau of Labor Statistics (BLS)

- College Factual

- National Center for Education Statistics

- O*NET Online

- Image Credit: By Pixabay under License

More about our data sources and methodologies.

Featured Schools

Request Info

Request Info

|

Southern New Hampshire University You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs. Learn More > |