What Do Investment Fund Manager Do?

Investment Fund Manager Job Description Plan, direct, or coordinate investment strategy or operations for a large pool of liquid assets supplied by institutional investors or individual investors.

Life As an Investment Fund Manager: What Do They Do?

- Perform or evaluate research, such as detailed company or industry analyses, to inform financial forecasting, decision making, or valuation.

- Present investment information, such as product risks, fees, or fund performance statistics.

- Attend investment briefings or consult financial media to stay abreast of relevant investment markets.

- Identify group or individual target investors for a specific fund.

- Prepare for and respond to regulatory inquiries.

- Manage investment funds to maximize return on client investments.

Featured schools near , edit

Qualities of an Investment Fund Manager

These are the skills Investment Fund Managers say are the most useful in their careers:

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Speaking: Talking to others to convey information effectively.

Judgment and Decision Making: Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Active Learning: Understanding the implications of new information for both current and future problem-solving and decision-making.

Types of Investment Fund Manager

- Senior Investment Analyst

- Institutional Asset Manager

- Mutual Fund Manager

- Vice President and Portfolio Manager

- Financial Planning Manager

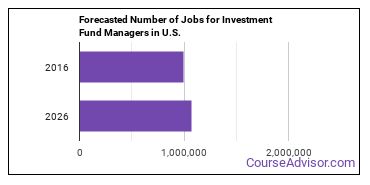

Investment Fund Manager Employment Estimates

There were about 992,100 jobs for Investment Fund Manager in 2016 (in the United States). New jobs are being produced at a rate of 8% which is above the national average. The Bureau of Labor Statistics predicts 79,600 new jobs for Investment Fund Manager by 2026. Due to new job openings and attrition, there will be an average of 79,200 job openings in this field each year.

The states with the most job growth for Investment Fund Manager are Utah, Washington, and Nevada. Watch out if you plan on working in Vermont, Maine, or Maryland. These states have the worst job growth for this type of profession.

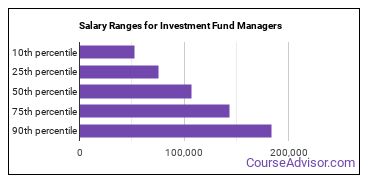

What is the Average Salary of an Investment Fund Manager

The typical yearly salary for Investment Fund Managers is somewhere between $52,550 and $183,430.

Investment Fund Managers who work in District of Columbia, Virginia, or California, make the highest salaries.

Below is a list of the median annual salaries for Investment Fund Managers in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $106,680 |

| Alaska | $118,650 |

| Arizona | $101,630 |

| Arkansas | $86,410 |

| California | $143,350 |

| Colorado | $138,490 |

| Connecticut | $129,730 |

| Delaware | $134,410 |

| District of Columbia | $147,460 |

| Florida | $99,240 |

| Georgia | $118,060 |

| Hawaii | $93,760 |

| Idaho | $85,070 |

| Illinois | $90,080 |

| Indiana | $71,560 |

| Iowa | $101,360 |

| Kansas | $102,560 |

| Kentucky | $92,630 |

| Louisiana | $87,080 |

| Maine | $96,570 |

| Maryland | $122,050 |

| Massachusetts | $131,450 |

| Michigan | $98,780 |

| Minnesota | $128,590 |

| Mississippi | $82,230 |

| Missouri | $97,820 |

| Montana | $76,990 |

| Nebraska | $101,380 |

| Nevada | $102,060 |

| New Hampshire | $123,580 |

| New Jersey | $138,820 |

| New Mexico | $96,490 |

| New York | $124,160 |

| North Carolina | $121,500 |

| North Dakota | $109,820 |

| Ohio | $107,320 |

| Oklahoma | $102,710 |

| Oregon | $94,400 |

| Pennsylvania | $126,290 |

| Rhode Island | $114,660 |

| South Carolina | $100,890 |

| South Dakota | $99,030 |

| Tennessee | $83,010 |

| Texas | $122,130 |

| Utah | $102,290 |

| Vermont | $105,950 |

| Virginia | $134,500 |

| Washington | $125,490 |

| West Virginia | $77,290 |

| Wisconsin | $85,050 |

| Wyoming | $100,310 |

What Tools & Technology do Investment Fund Managers Use?

Although they’re not necessarily needed for all jobs, the following technologies are used by many Investment Fund Managers:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Microsoft Access

- SAP

- Microsoft Project

- Microsoft Visio

- Structured query language SQL

- SAS

- Oracle Hyperion

- Financial accounting software

- Statistical analysis software

- Microsoft MapPoint

- Autodesk AutoCAD Blue Sky

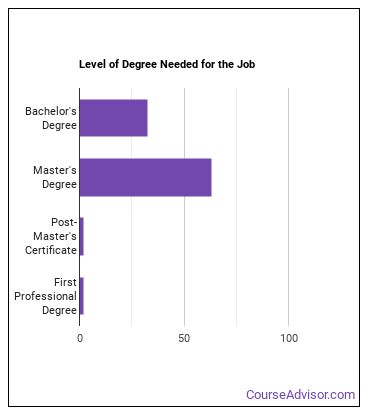

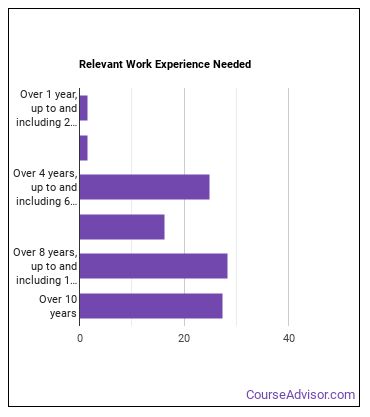

Becoming an Investment Fund Manager

Are there Investment Fund Managers education requirements?

How Long Does it Take to Become an Investment Fund Manager?

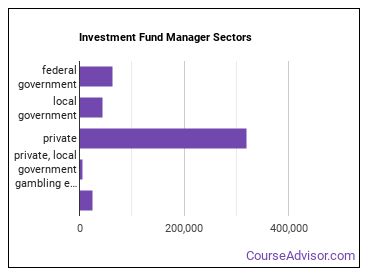

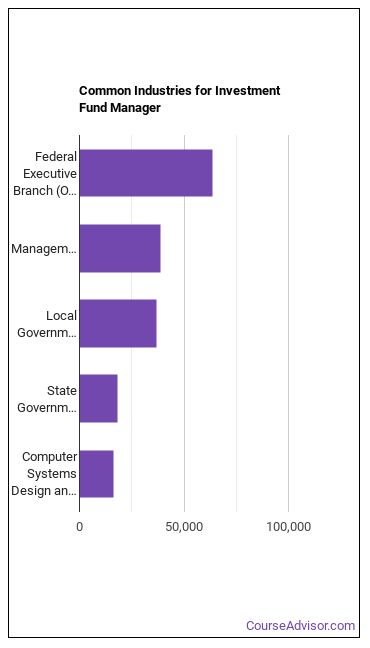

Who Employs Investment Fund Managers?

The table below shows some of the most common industries where those employed in this career field work.

References:

Image Credit: Mike Moore via public domain

More about our data sources and methodologies.

Featured Schools

Request Info

Request Info

|

Southern New Hampshire University You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs. Learn More > |