What You Need to Know About Credit Counselor

Job Description: Advise and educate individuals or organizations on acquiring and managing debt. May provide guidance in determining the best type of loan and explaining loan requirements or restrictions. May help develop debt management plans, advise on credit issues, or provide budget, mortgage, and bankruptcy counseling.

Life As a Credit Counselor: What Do They Do?

- Recommend strategies for clients to meet their financial goals, such as borrowing money through loans or loan programs, declaring bankruptcy, making budget adjustments, or enrolling in debt management plans.

- Assess clients' overall financial situation by reviewing income, assets, debts, expenses, credit reports, or other financial information.

- Prepare written documents to establish contracts with or communicate financial recommendations to clients.

- Explain general financial topics to clients, such as credit report ratings, bankruptcy laws, consumer protection laws, wage attachments, or collection actions.

- Prioritize client debt repayment to avoid dire consequences, such as bankruptcy or foreclosure or to reduce overall costs, such as by paying high-interest or short-term loans first.

- Conduct research to help clients avoid repossessions or foreclosures or remove levies or wage garnishments.

Featured schools near , edit

Credit Counselor Needed Skills

Credit Counselors state the following job skills are important in their day-to-day work.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Speaking: Talking to others to convey information effectively.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Service Orientation: Actively looking for ways to help people.

Types of Credit Counselor Jobs

- Mortgage Counselor

- Credit Representative

- Loan Counselor

- Financial Aid Advisor

- Collections Specialist

Job Demand for Credit Counselors

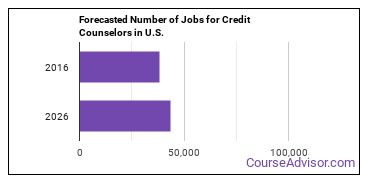

In the United States, there were 38,300 jobs for Credit Counselor in 2016. New jobs are being produced at a rate of 13.8% which is above the national average. The Bureau of Labor Statistics predicts 5,300 new jobs for Credit Counselor by 2026. The BLS estimates 3,800 yearly job openings in this field.

The states with the most job growth for Credit Counselor are Utah, North Dakota, and Idaho. Watch out if you plan on working in Wyoming, Vermont, or Maine. These states have the worst job growth for this type of profession.

Average Credit Counselors Salary

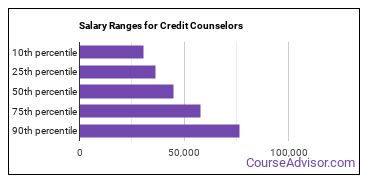

The salary for Credit Counselors ranges between about $30,440 and $76,690 a year.

Credit Counselors who work in District of Columbia, New Jersey, or Nevada, make the highest salaries.

Below is a list of the median annual salaries for Credit Counselors in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $48,260 |

| Arizona | $45,880 |

| Arkansas | $49,770 |

| California | $53,170 |

| Connecticut | $57,500 |

| Delaware | $52,360 |

| District of Columbia | $77,690 |

| Florida | $45,530 |

| Georgia | $51,720 |

| Hawaii | $47,810 |

| Idaho | $42,490 |

| Illinois | $47,290 |

| Indiana | $45,030 |

| Iowa | $43,690 |

| Kansas | $47,910 |

| Kentucky | $44,590 |

| Louisiana | $36,840 |

| Maine | $40,880 |

| Maryland | $47,330 |

| Massachusetts | $57,600 |

| Michigan | $48,340 |

| Minnesota | $51,190 |

| Mississippi | $42,660 |

| Missouri | $53,250 |

| Montana | $44,540 |

| Nevada | $56,510 |

| New Hampshire | $45,850 |

| New Jersey | $68,360 |

| New Mexico | $37,870 |

| New York | $60,520 |

| North Carolina | $54,400 |

| North Dakota | $43,330 |

| Ohio | $51,200 |

| Oklahoma | $42,290 |

| Oregon | $48,090 |

| Pennsylvania | $55,770 |

| Rhode Island | $59,760 |

| South Carolina | $45,320 |

| South Dakota | $38,900 |

| Tennessee | $48,560 |

| Texas | $46,160 |

| Utah | $38,070 |

| Virginia | $50,860 |

| Washington | $48,230 |

| West Virginia | $38,910 |

| Wisconsin | $39,860 |

| Wyoming | $50,960 |

Tools & Technologies Used by Credit Counselors

Below is a list of the types of tools and technologies that Credit Counselors may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Microsoft Access

- Email software

- SAP

- Microsoft Dynamics

- Oracle PeopleSoft

- LexisNexis

- Freddie Mac Loan Prospector

- Chat software

Becoming a Credit Counselor

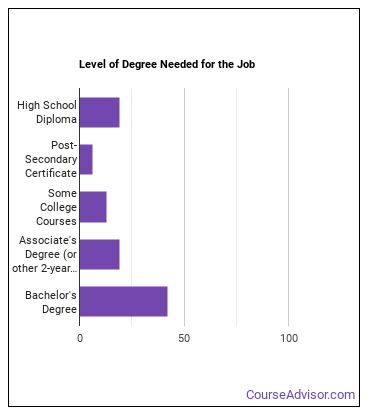

Education needed to be a Credit Counselor:

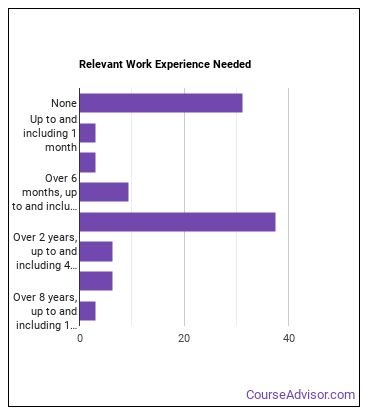

How many years of work experience do I need?

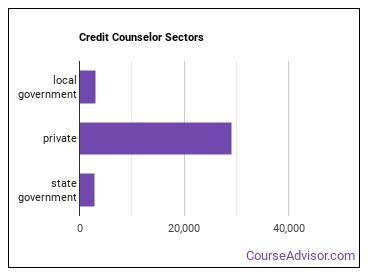

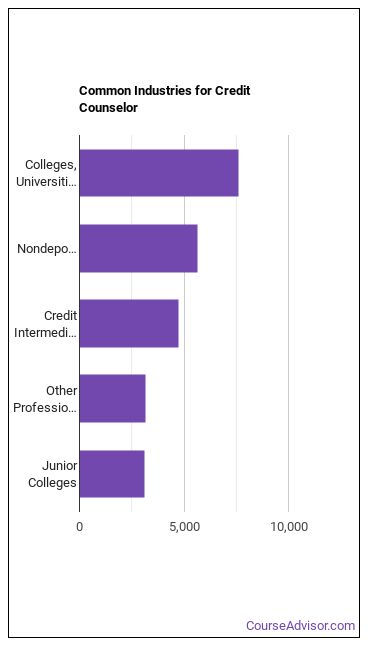

Where Credit Counselors Are Employed

The table below shows the approximate number of Credit Counselors employed by various industries.

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.

Featured Schools

Request Info

Request Info

|

Southern New Hampshire University You have goals. Southern New Hampshire University can help you get there. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Find your degree from over 200 online programs. Learn More > |